Hyundai Motor Co. is hopeful the semiconductor shortage afflicting the global auto industry will ease next quarter and that its sales will return to pre-pandemic levels this year, according to the company’s executive vice president, Gang Hyun Seo.

Speaking in a call following Hyundai’s quarterly earnings, which missed analyst expectations, Seo said the chip crunch would likely continue until the end of the current quarter, with production normalizing after then.

Hyundai said earlier Tuesday that operating profit in the three months through December fell 6.8% from a year earlier to $1.28 billion, lower than the $1.49 billion average estimate of analysts tracked by Bloomberg. Its operating margin for 2021 was 5.7%.

Consolidated net income slid 57% to $456 million, far below the $1.22 billion estimate. Sales, however, totaled $26 billion, up 6.1% and marginally higher than estimates, thanks to a weaker Korean won and sales of value-added products.

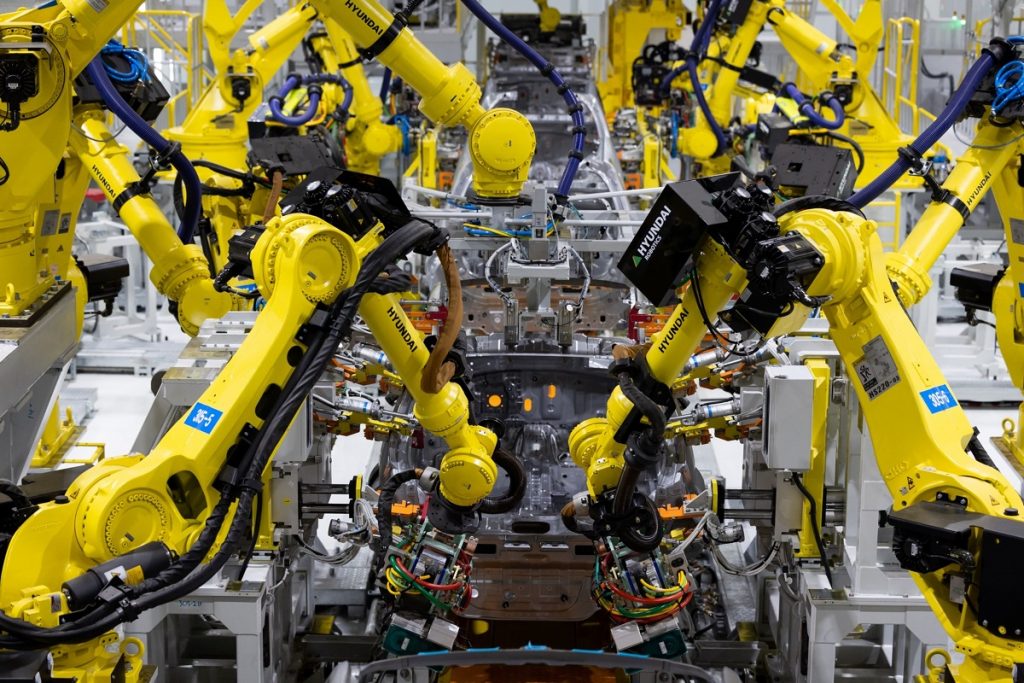

Robots assemble Hyundai Motor Co. Casper mini sport utility vehicles on the production line at the Gwangju Global Motors (GGM) factory in Gwangju, South Korea, on Wednesday, Oct. 13, 2021. (Bloomberg)

Hyundai shares fell as much as 3.6%, the most since Oct. 1. They pared the loss to close down 1.3%.

The company’s global retail sales declined 15% last quarter, with a slump of 43% in China. South Korea and North America sales fell 8.9% and 7.9%, respectively. Europe was an outlier with a 7% increase.

RELATED: Alabama-built vehicles help Hyundai, Honda to successful years

Hyundai aims to sell 4.32 million vehicles this year, including a 30% increase in eco-friendly cars. They will account for up to 40% of sales in Europe versus 32% in 2021, the company said. Its new Ioniq 6 electric car will be released in South Korea in the first half of the year.

Pyoung-Mo Kim, an analyst at Seoul-based DB Financial Investment, said prior to the results that a return to normal production for Hyundai could be delayed to late this year as chipmakers such as Taiwan Semiconductor Manufacturing Co. may raise prices.

In addition to supply-chain snags, higher commodity prices have been a burden. Hyundai said in November that the cost of iron ore in the third quarter jumped 63% from a year earlier to $165 a ton, while aluminum rose 40% to $2,384 a ton and copper climbed 48% to $9,188 a ton.

Hyundai’s share of the global EV market is estimated to be 5.7% based on sales from January to November 2021, according to data from Seoul-based Hana Financial Investment.

(With assistance from Hongcheol Kim.)